Dave,Thanks for the great first week and a half. My acct. is up 150% playing options on 3 of your picks. Your burning match theory is right on. Thanks, Mark- SRP Member 7/30/16

I couldn’t be happier with your services and professionalism. I’m blown away by your response time and even more so, how simple and easy you made this process. I continue to only speak the highest of SRP. You’re great. Thanks again, Dave. Take care, Steven- SRP Member 7/29/16

Ballistic Moves ahead in Gold? SP 500 on verge of another move? Read on…

SRP projected all time highs back on May 9th and kept with the forecast. We modified targets to 2176 on July 4th as major resistance and that so far as been the case:

The SP 500 has marked 12 trading days of consolidation as part of Major wave 3 of Primary 5 from the 1991 lows of Major 2. We are in the middle of Primary Wave 5 up in the Bull market which is the final leg of the journey from 666 lows back in March 2009. Below is both our Long Term updated views and the intermediate views. We see 2191 and 2245 as our bogeys ahead. Normally on Day 13 we get a shift, in this case we expect it to be upwards to new highs. 2138 remains key support on the downside.

There are a few caveats to pay attention to in terms of the rally.

1. The Bulls in surveys are now 53% vs. only 21% for Bears (Investment Advisors) This is typical during a bullish wave and keeping in mind we are in a “3rd of a 3rd” pattern which tends to be the most bullish in terms of optimism and movement.

2. VIX Volatility levels trading near Bull Cycle lows here under 12. This though again would be typical during a 3rd of a 3rd pattern up from the 1991 Major 2 lows:

3. Fear and Greed index running hot, but again typical of 3rd wave of of 3rd wave

Gold about to go Ballistic?

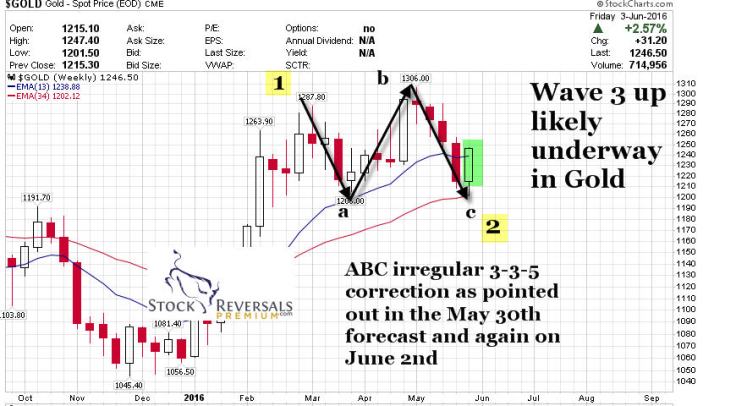

With the above in mind, we continue to expect further all time highs ahead. We turn our attention to another Bull Cycle which is Gold. Back on June 1st we projected a Major wave 2 low at 1195-1205 for Gold and we bottomed at 1201. The rally to 1377 spot was Wave 1 of 3 and then Wave 2 bottomed at 1310 this past week. We could see a super surge up in Gold near term as we are possibly in a bullish “wave 3 of 3” right now from 1310. Two charts are presented below both the long term and intermediate views: We put out a 1460 target back on June 1st, and that is still on track

Biotech also has been moving:

We projected a rally in the XBI ETF about two weeks ago to our SRP members to go from 56 to 63, and so far that has been on track. Institutions are seeing values in the space after a long Wave 2 down and sideways grind. (We had pointed out a 7 wave rooftop grinding pattern several weeks ago. We still would like to see IBB over 294 to confirm new Bull cycle.)

Oil has been tough:

Watch 43.18 and 44.81 as resistance rally targets

This is one of the hardest areas to forecast due to inventory reports being volatile and the comings and goings of refiners stocking and drawing down, plus drilling etc. However, our best projection is this is a Wave 4 bump up here from sub 41 this past week and a rally may be short lived. There could be one more down leg to finish this correction from 51.67

COPPER ready to roll?

Finally the last man standing near the bottom and trying to get up and run is Copper. We have speculated Copper may be close to breaking out a few weeks ago. Near term the ball is in Dr. Coppers court, but if this pattern runs to the upside you could see some nice moves in small cap copper stocks and others: $2.18 is key support

Everyone is a genius in a Bull market, so make sure you are staying disciplined and taking your profits on flare ups. Our belief is we are best of as Swing Traders in any market cycle, and we liken swing trades to burning matches. When a stock or ETF is flaring up like a match, we are booking profits on usually 1/2 the position and then trying to ride the remainder for more gains later on. We had some nice flareups in VUZI and NERV recently at SRP which we took gains on, as well as LABU ETF just to mention a few. Our last 6 closed out trade positions were gains of 8%, 13%, 13% 16% and 18% on various tranches of trades from entry points. We dont quibble usually over whether a stock we sold may go higher, we are on to the next low risk high return set up. This books cash into the portfolio and banks gains while reducing risk along the way. Its how we beat the markets in all cycles and every quarter consistently. Once you start thinking you are a genius and smarter than the market, thats when you go off the rails. Stick with the discipline, learn from mistakes, but dont blow up your account getting cute.

Our last 5 closed out positions at SRP: Several positions open now with paper gains

7/27- Sold Final 1/2 VUZI for 8% Gains on 1/2 Position Size (5% Equivalent)

7/26- Sold Final 1/2 LABU ETF for 16% Gains on Full Position

7/26- Sold Final 1/2 NERV for 15% Gains on Full Position

7/25- Sold 1/2 VUZI for 18% Gains on 1/2 Position Size (5% equivalent)

7/21- Sold 1/2 LABU for 13% Gains on Full Position

This brings us to our Weekly Forecast section of Swing Trade ideas. These are a small list of ideas for futher review. Stocks with nice base patterns and good fundamentals both. At SRP we focus big time on share structure, price to sales ratios, earnings, catalysts, management and more… not just the chart. If all you do is trade charts, your going to wake up one morning with a smack in the face loss. We like to assume that even if we stop out of a swing trade for a loss, that the fundamentals are probably going to emerge and turn that loss into a gain later on in case anyone got stuck in the trade. Recent samples being EW, ETSY, YIN just naming a few.

Stock Ideas:

LGIH- Many weeks on the list, ascending base pattern. Builds entry level homes in high growth areas, PE Ratio 13 strong growth.

AHS- $42.30- Pullback may offer better entry here during this 4 week base. Permanent and Temporary Staffing for Physicians and Nurses etc.

MXL- Chip maker with strong annual growth in an ascending 4 week base. Has been on our lsit off and on for weeks.

GRUB- Big move up in earnings for Grubhub this past week, a nice pullback to 34-35 would be a good entry from this $37.92 area, may or may not happen.

SIMO- 4 week base pattern for this Taiwanese designer of Microcontrollers and other chip related products.

MBLY- Mobile Eye already reported strong earnings and then a notice of no longer working with Tesla. Stock dropped but rallied back up from 40 to 48 area. Has a gap at 45.33 if it fills would be better entry area

PLNT- Planet Fitness is in a tight 3 week base. 7.3 million members pay about $10 a month in 47 states to stay in shape.

FB- Broke out on strong earnings and pulled back post earnings but still riding above weekly trend lines. Could be good entry here at 122-124 ranges for longer term investors.

Other quick ideas: KRA, LMNX, NTGR, RP, STLD all leaders in nice bases.