Weekly Forecast SP 500 Gold Oil and More Post Brexit

Late last week SRP Members cashed out of a 2 day swing trade for 25-30% profits in the NUGT ETF. Consider joining us for this type of forward-looking advice, morning updates daily on all positions and markets, Gold, Oil etc and strategy reports, plus swing trades via SMS Text and Email/Post alert with entry, exit, and ongoing advice. Read up at www.stockreversalspremium.com

Not ready to consider the leap to our Premium Service but like Forecasts and Ideas? Opt In Free for our StockReverals free membership and recieve 2-3 updates via Email per week. We do not share your email with any other entity ever. Sign Up here with Name and Email only… click section below to go right to sign up page.

Forecast is for Cloudy skies with chance of Sun later. The Brexit outcome may force us to adjust our intermediate views as well, now that we have new information we didn’t have as of Thursday last week. One must be willing to adjust their opinion and stay open-minded. Borrowing a famous phrase… “strong opinions weakly held”. Simply means… stay open-minded to all inputs, but also don’t change your mind every day either.

– Dave, Chief Strategist

We should start of this weekly forecast report by saying that nobody in their right mind can pretend to know the near term movements of the markets following the Brexit vote results this past week. So lets first start by backing up a little bit on our recent views and then bringing that forward to what we are dealing with today in terms of the SP 500 and general markets.

Recently we adjusted our views to a 2145 SP 500 target top off the 2025 “Wave 4” lows. We outlined a likely ABCDE pattern with 2120 as our recent target after the 2050 pivot. We hit 2123 on Thursday after the market closed briefly, so our C wave was met. Then of course Friday we obviously tanked hard around the world which threw our “D” wave pullback pretty deep and much lower than our pattern had suggested.

So here is that ABCDE Forecast for starters prior to Brexit vote: We did this for our SRP members on Tuesday this past week in pre-market. You can see our 2120 C target in yellow:

We hit the 2113 on the close for C, with 2123 the after hours high. Check that box off as done. Then regardless of the Brexit outcome we expected a D wave pullback maybe to 2095 or so. Obviously Friday that got obliterated which put the close at 2037, also below a 2045 pivot point.

That means in our view, we are adjusting the near term outlook to a 2002 pivot support low right now. We believe the market could bottom on Monday based on 3 weeks down in a row which is rare and 13 trading days. It looks like the Brexit exit caused a change in character obviously for the markets , so we need to adjust our views a bit and then monitor and go from here. At 2002 it would be a shallow correction of the rally from 1810-2120.

Underneath the indexes we can look at a few market internal clues to help us out as well. We are now seeing the % of stocks below their 50 day moving average dropping to 43% after this weeks downside and 3 weeks of correction. This is a fairly low number and means internals are weak, but also getting oversold. If we zoom out to the % of stocks below the 200 day moving average, we see that number at 61%, correcting from 71%.

The Market has only had a few instances in the last several years where the SP 500 index was down 3 weeks in a row. In all but one instance the market rebounded very shortly thereafter, so we would look for a washout already upon us and a rebound likely. Keep your eyes on 2002 as the LOW END PIVOT for key support

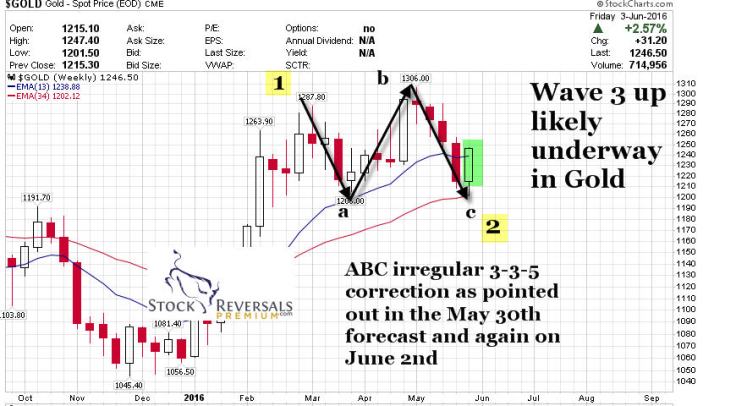

GOLD RALLY UPDATE

In terms of Gold, we nailed the ABC bottom forecast back in early June, looking for 1195-1206 as a bottom. Gold bottomed at 1201 and then rallied 118 points to 1319 per ounce in US dollars. Recently a pullback to 1247 put in a near 61% Fibonacci wave 2 retracement ahead of the Brexit vote.

25% Gain in NUGT ETF!! One member Emailed us with enthusiasm:

Morning, Thanks for the NUGT trade. I got in @ $93 even and sold in the pre-market @ $125.70. Got to love that! Thanks, Doug D. SRP Member 6/25/16

SRP Members were alerted on Wednesday this past week to be bullish on Gold, and we did that viaNUGT ETF which is 3x long the Gold stock sector. Our feeling was no matter the outcome, Gold was bottoming in a Wave 2, and would rally after Brexit vote. We didnt expect the vote to go the way it did, so Gold rallied alot more than we thought. This benefited our members to the tune of a 25-30% 48 hour gain in NUGT, which we sold in pre -market and the open on Friday.

Here is our updated Gold view and we came up with $1460 per US ounce as our intermediate target a few weekends ago:

Wave 1 1045-1288; Wave 2 1288-ABC Irregular to 1201; Wave 3 underway from 1201, 1360 the high so far… 1460 the LOW END target.

Gold rallied 113 points from 1247 to 1360 overnight at the highs, and that is why we alerted to take those NUGT profits in pre -market on Friday morning. The rally was equal or close to the length of the 1201-1319 rally, indicating a D wave or minor pullback would ensue, which it did on Friday.

OIL UPDATE

Oil is still in a D wave pattern we projected a few weeks back in the forecast report. We felt at 51.67 that Oil had peaked in a C equals A pattern. The D wave can be tricky, but we projected 47.80 and or 45 as likely bottoms. So far the low of Oil was around $46. We expect it to reach 55-57 after this D wave confirms a bottom for an E wave high on the low-end.

BIOTECH UPDATE:

Finally we update our Biotech views since this is an area we often cover with research. This past week we saw the IBB ETF attempt a rally which then faltered on Brexit news and the market sell off. We had suggested a week or so ago that IBB was still in trouble and would be testing a 255 key support area, which it broke on Friday. Later in the week we updated a chart on stocktwits showing a sideways running “rooftop” correction pattern. These can go on for 5, 7 , 9, even 11 waves. For now, we are forming another possible pivot bottom with 241 area key: Note the rooftop pattern.

Earlier in the week during the market rally we took money off the table at SRP on a Biotech swing play with 10-12% gains. Later that stock gave back all of those gains by end of day Friday and had us back to break even on the initial entry point for the final 1/2. This is why as swing traders we are very big on forcing our SRP members to book profits on the way up, usually by selling 1/2 on the way to our objectives. The reason is you reduce portfolio risk, raise cash, and bank money while the swing is in your favor. There is nothing worse than watching a gain turn to a loss.

The bottom line concerns for the markets near term are the effects on fragile European economies and the potential unwinding of trade agreements that may extend past Britain at some point. The uncertainty will cause further disruption. The US is heavily insulated against the economy of Britain, but the issue would be any spillover effects or other countries following suit.

Bottom Line?

- For the near term we would continue to be bullish on Gold due to NIRP policies and currency wars, and we have been bullish on Gold for quite awhile.

- Oil should correction and likely head back up if 45 holds.

- SP 500 needs to hold 2002 to keep bull trend or consolidation alive.

We will see what Monday brings, but we think a possible washout low early this week and 2002 again being key to watch. If markets don’t totally melt down we may see some great opportunities near term.