If you are not yet an SRP Premium Member, consider just the following metrics: Read more at www.stockreversalspremium.com For just $99 you can start your SRP membership today!

If you are not ready to make the leap to our Swing Trade and Forecast service, Opt-In Free today for forecast updates and interim ideas in our Free Service here: OPT IN HERE Just need name and email, we will not share with anyone ever.

Most recent 5 weeks of All Closed Swing Trades into end of Quarter for SRP Members:

A full position is a 10% allocation and 1/2 Position is a 5% allocation

7/1- Sold 1/2 CLF for 14% Gains on Full Position (3 days on back half we added)

6/29- Sold 1/2 LABU for 14% Gains on Full Position (1 Day)

6/29- Sold 1/2 LABU for 12% Gains on Full Position (1 day)

6/24- Stopped out EW for 4% Loss (Brexit day)

6/24- Stopped out WYNN for 7% Loss (Brexit Day)

6/24- Sold NUGT 1/2 Position for 34% Gains (Original 1/2 position only 5%)

6/22- Sold 1/2 NERV for 10-12% Gains on Full Position

6/10- Sold UBNT for 5% Average Gains on Full Position

6/10- Sold FMC for 4-5% Gains on Full Position

5/31- Sold Final 1/2 CLF for 35% Gains on Full Position @$4.10

5/26- Sold Final 1/2 WLL for 18-20% Gains on Full Position

5/26- Sold 1/2 CLL for 12% Gains on Full Position

5/25- Sold 1/2 WLL for 8.5% Gains on Full Position

We first projected all time highs for the SP 500 back in early May in our forecasts looking for 2160…

Though there have been ups and downs since that time, we stayed the course. The only changes we made were the initial low end pivot projections, but all of them (2160, 2145, 2176) were all time highs. In our most recent weekly forecast on July 4th we projected a Wave 3 rally from 1991 was underway, and that would require all time highs with a 2176 initial pivot projection.

This past week we hit 2129 to close at all time closing highs for the SP 500. We will be clear that this 2176 level is our low end projection and would only be a low end wave 3 from 1991 wave 2 low after Brexit bottom.

- Primary wave 5 is made up of 5 major waves.

- Major 1 1810-2111

- Major 2 2111- 1991 (ABC Irregular pattern)

- Major 3 1991- 2129 so far with 2176 our LOW END projection

- Then Major 4 corrects 3 and then Major 5 completes the rally from 1810

This week we plan to look back and then look forward a bit on SP 500 and Gold: Lets look at some older charts we did and then update them again:

Here is our May 29th Weekly Forecast report chart. At the time it looked like the 2111 pivot was Wave 3 up from 1810. Then we had the ABC for Major 4, then 1 of Major 5 was underway. You will see we projected 2160 back then. What changed is the pattern post Brexit caused a massive disruptive drop to 1991, thereby changing the count a bit, but not the all time highs projection:

Last week in our Weekly report, we updated our views to below: Here you can see we changed the pattern to Major 1 at 2111, Major 2 at 1991 (ABC Pattern) and then 3 beginning from there with a noted 2145-2176 initial projection. That is working out well:

That brings us to the Weekly Report chart for July 10th: We are in wave 3 of 3 of 5 from 1991 om daily charts and Major 3 from 1991 on the weekly.

SP 500 Bottom Line: All time highs are now official on a closing basis, and 2176 is our intermediate target for this Major 3 up from 1991, that is a low end target.

GOLD UPDATES:

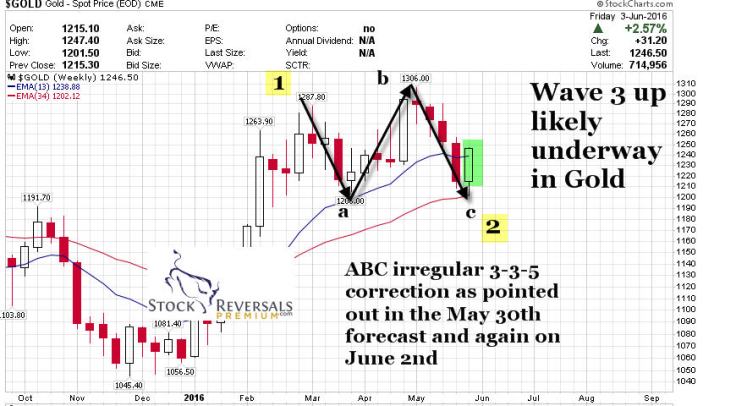

Gold has continued to consolidate recent gains after we projected Wave 2 low in late May, early June. Our target was laid out for 1460 on the low end for Major wave 3 up in Gold off the 1045 Bear Cycle Lows.

Here was our June 5th Forecast report Gold chart showing Gold likely in Wave 3 up, and at the time we were at 1246 spot:

Here is our updated July 10th Gold Chart showing again Wave 3 still underway from 1201: Continuing Major Wave 3 from 1045 Bear cycle lows. Gold benefits greatly from NIRP Policies around the world, Fiat currencies are not attractive.

- Major 1 1045-1306

- Major 2 1306-1201 ABC Irregular

- Major 3 1201- 1460 minimal projection

OIL UPDATES:

Finally, that brings us to Oil: We have been calling for a Wave D correction after the initial ABC projetion we made for $52 a barrel when Oil was back at $29. We hit $51.67 and have been in a varying degree of correction ever since. Our targets for D which we laid out many weeks ago were 47.80 and or 45 on the low end. This past week it looked like Oil was going to break out past 50 soon and get the E wave rally underway. Then we got hit with a poor inventory report and Oil got slammed. That creates uncertainty in the patterns and we will be the first to admit the projecting Oil is much harder than the SP 500 and Gold.

Here was our Oil chart from June 10th showing possible pivot for D near $45, so that is where we sit now 4 weeks later:

Here is the Updated July 10th Oil Chart:

Last week was a vacation week and now we are back underway with Active Swing Trades. SRP closed out the 2nd quarter with a flurry of positive trades and we look forward to an exciting 3rd quarter of action ahead. We will have our full 2nd quarter track record updated online early this week in our Track Record tab with all closed out trades graphed out and noted.

Summary:

- SP 500 should be attacking the 2176 pivot zone ahead as part of a 3rd wave up from 1991

- Oil is in a tough $45 test area, we would like to see this hold for our ABCDE pattern to continue

- Gold remains in a bull market and 1460 is our intermediate target